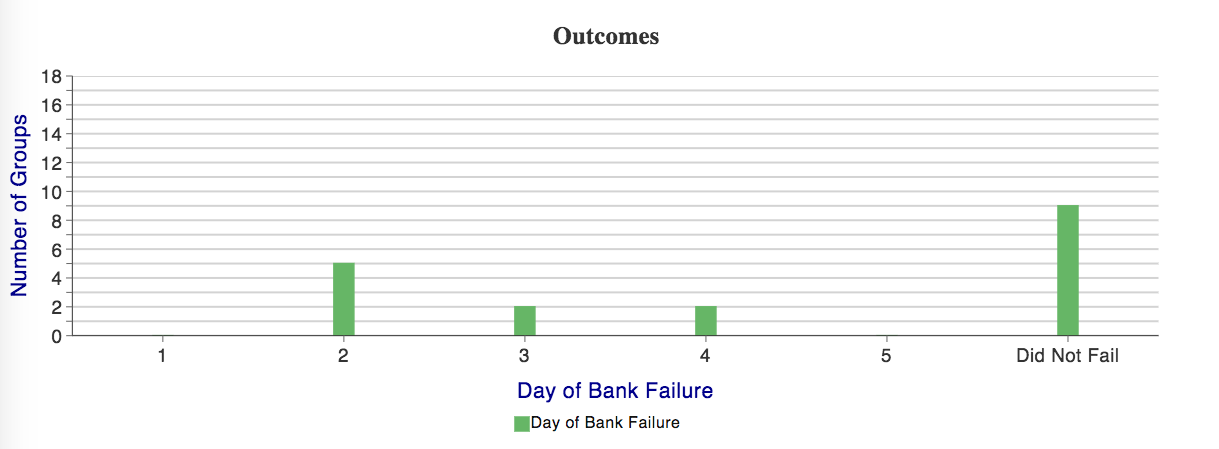

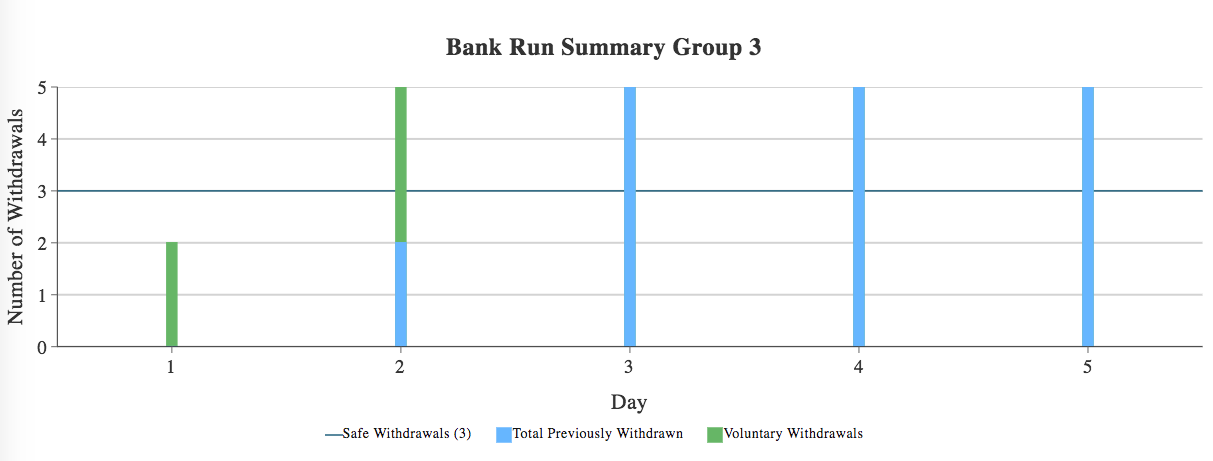

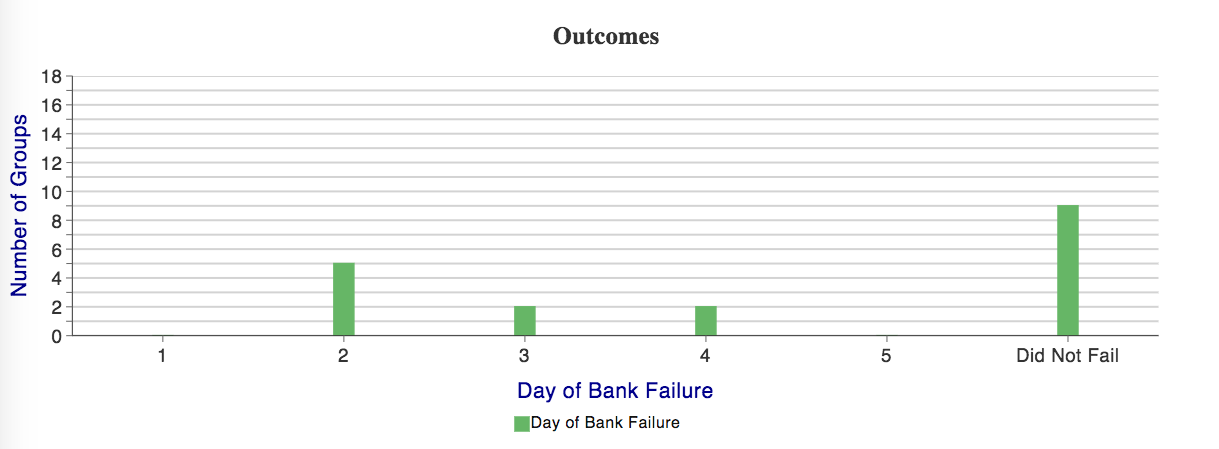

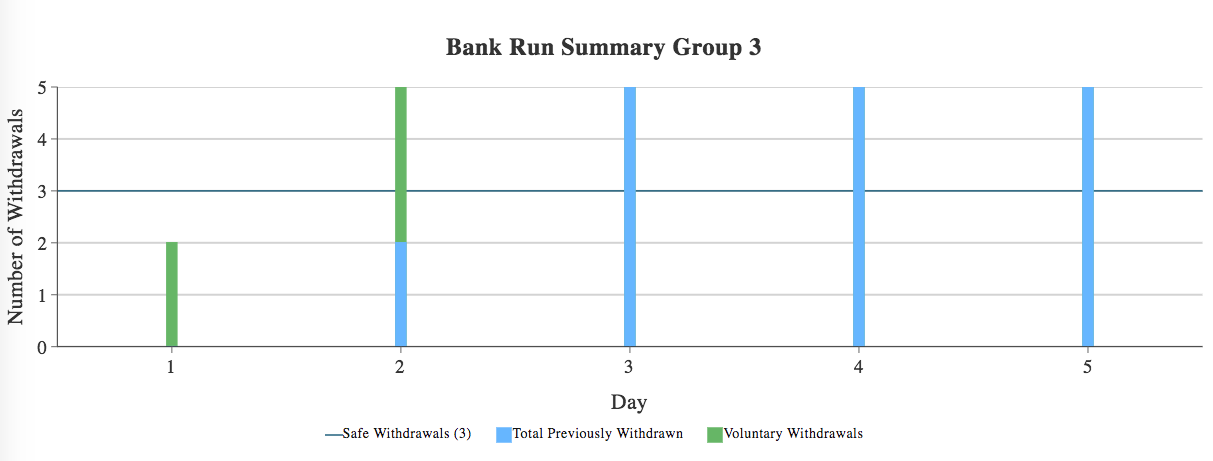

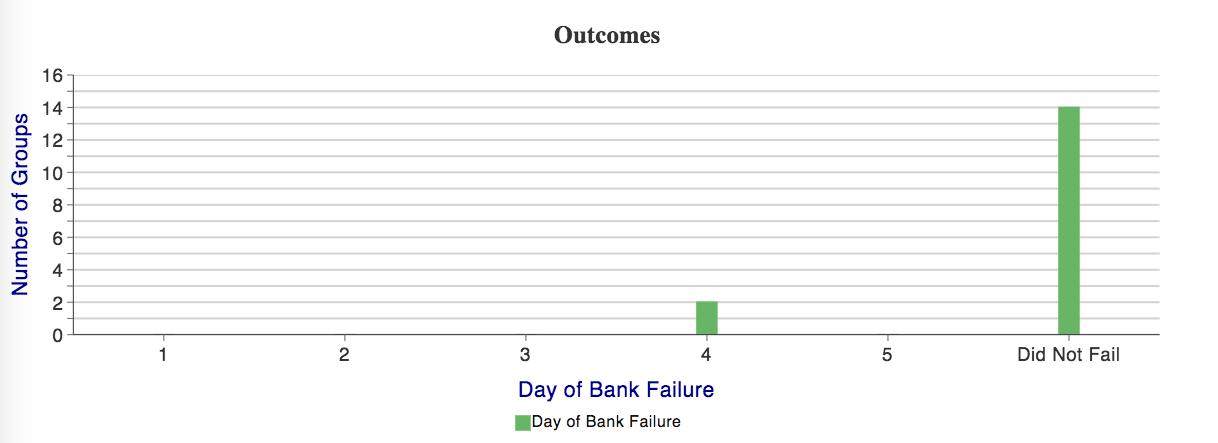

Before the SEA meetings I lectured with MobLab at the University of Virginia. We conducted the Bank Run game with two simple objectives:Show that fractional reserve banking is inherently fragile and prone to panic, and Have students experience the same situation but with deposit insurance that reduces the downside risk of a bank run. I explained the setting to the students. They were embedded in groups of six. Each having made a $100 deposit in a bank. There were five days to maturity on that deposit. If the bank was solvent at the end of five days they received a 50 percent return. Each student has a decision, "To withdraw, or not to withdraw, that is the question!" The liquidation rate on the bank's portfolio was 60 percent and there was no deposit insurance.After describing the instructions I ran students through a quick comprehension survey. Then we started the game. The atmosphere was electric. The students were talking amongst each other. Walking up and down the rows I heard people talking about the payoffs associated with different outcomes and their beliefs about the others in their group.The first game students played was without deposit insurance. 50% of banks failed and there were an average of 3.11 depositors per group at the end of the game. The aggregate data on bank failure is below along with a typical pattern. In these situations what often happens is one or two early withdrawals followed by a mad dash next round to secure even a fraction of their deposits.

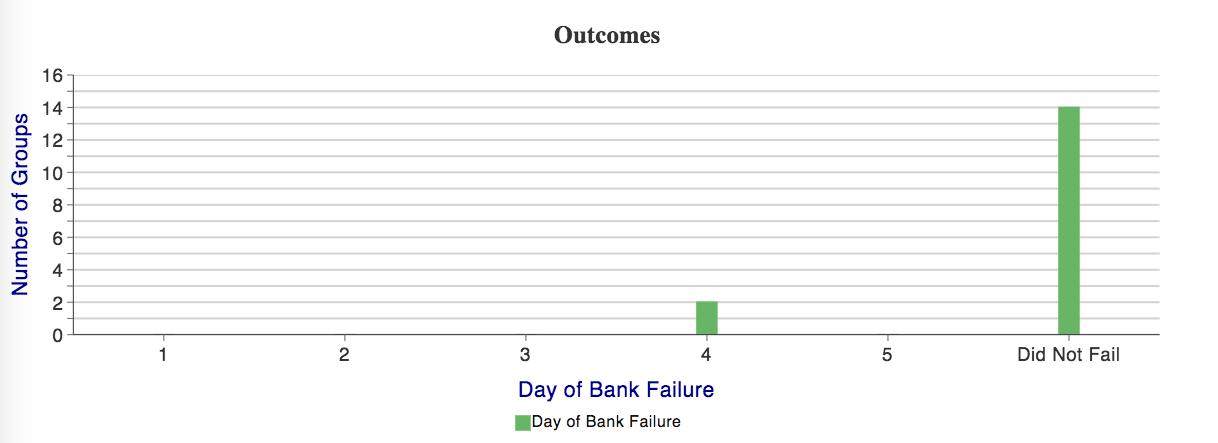

I didn't show the students this data. After that game finished I announced the next game would be different. If a bank failed all depositors would receive 80 percent of their deposit back. Lo and behold only two banks failed and there were an average of 5.25 depositors per group at the end of the game.

I didn't show the students this data. After that game finished I announced the next game would be different. If a bank failed all depositors would receive 80 percent of their deposit back. Lo and behold only two banks failed and there were an average of 5.25 depositors per group at the end of the game. So 50 percent failure v. 11 percent failure. Confidence is everything. After the game we talked about their thought process, the data, typical patterns, and I had them walk through the following two questions:

So 50 percent failure v. 11 percent failure. Confidence is everything. After the game we talked about their thought process, the data, typical patterns, and I had them walk through the following two questions:One possible solution to bank runs would be to force banks to retain a high fraction of their deposits (higher reserve requirement). Would that policy work? What would the implications of such a policy be? The purpose of Federal Deposit Insurance (FDIC) is to assure depositors their savings is safe. This reduces panic and enables banks to make loans. Does insurance against downside events have implications for the kinds of loans banks make? So basically, "Compared to what?" and "What happens next?" the two best economic questions. It was a great experience. The students loved it and 90.4% said it helped them better understand their class content. So use the bank run game in your class. Nothing like the smell of panic and crises in the morning!

I didn't show the students this data. After that game finished I announced the next game would be different. If a bank failed all depositors would receive 80 percent of their deposit back. Lo and behold only two banks failed and there were an average of 5.25 depositors per group at the end of the game.

I didn't show the students this data. After that game finished I announced the next game would be different. If a bank failed all depositors would receive 80 percent of their deposit back. Lo and behold only two banks failed and there were an average of 5.25 depositors per group at the end of the game. So 50 percent failure v. 11 percent failure. Confidence is everything. After the game we talked about their thought process, the data, typical patterns, and I had them walk through the following two questions:

So 50 percent failure v. 11 percent failure. Confidence is everything. After the game we talked about their thought process, the data, typical patterns, and I had them walk through the following two questions: